What Does Matthew J. Previte Cpa Pc Mean?

Table of ContentsGetting My Matthew J. Previte Cpa Pc To WorkMatthew J. Previte Cpa Pc for BeginnersIndicators on Matthew J. Previte Cpa Pc You Should KnowSome Known Incorrect Statements About Matthew J. Previte Cpa Pc Matthew J. Previte Cpa Pc Fundamentals ExplainedThings about Matthew J. Previte Cpa Pc

Tax obligation legislations and codes, whether at the state or federal degree, are as well made complex for most laypeople and they change frequently for many tax specialists to keep up with. Whether you just require somebody to aid you with your organization revenue taxes or you have actually been charged with tax obligation scams, hire a tax attorney to assist you out.

Some Known Facts About Matthew J. Previte Cpa Pc.

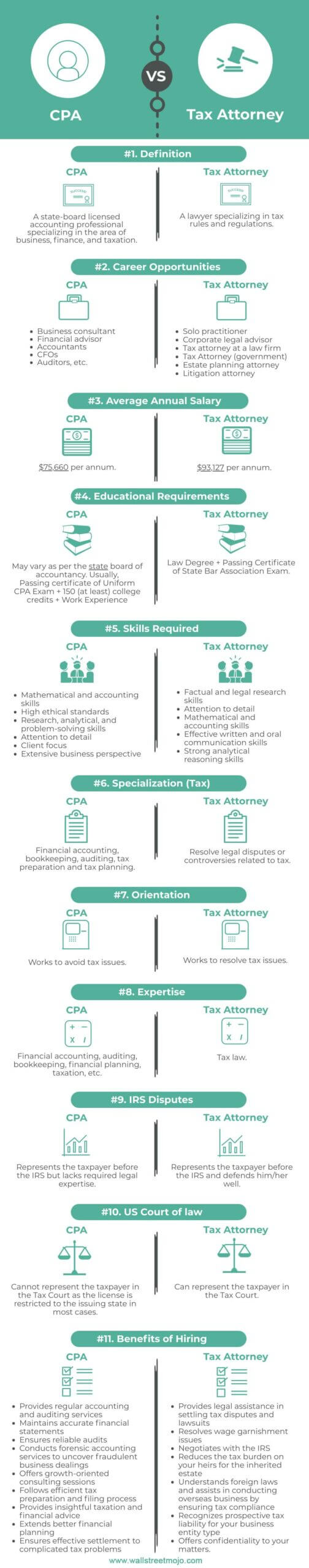

Everyone else not just disapproval taking care of taxes, but they can be outright afraid of the tax obligation companies, not without reason. There are a couple of questions that are constantly on the minds of those who are dealing with tax obligation issues, consisting of whether to employ a tax obligation attorney or a CPA, when to employ a tax obligation lawyer, and We intend to aid respond to those questions below, so you know what to do if you locate yourself in a "taxing" situation.

A lawyer can stand for customers prior to the IRS for audits, collections and appeals however so can a CPA. The large distinction below and one you require to bear in mind is that a tax obligation legal representative can provide attorney-client opportunity, implying your tax obligation legal representative is excluded from being compelled to testify against you in a court of law.

Matthew J. Previte Cpa Pc for Beginners

Otherwise, a CPA can indicate versus you even while benefiting you. Tax obligation attorneys are much more acquainted with the numerous tax settlement programs than the majority of Certified public accountants and understand how to pick the finest program for your case and just how to obtain you qualified for that program. If you are having a trouble with the internal revenue service or just inquiries and worries, you need to hire a tax obligation lawyer.

Tax Court Are under examination for tax fraudulence or tax evasion Are under criminal examination by the IRS Another crucial time to hire a tax obligation attorney is when you obtain an audit notice from the internal revenue service - tax lawyer in Framingham, Massachusetts. http://prsync.com/matthew-j-previte/. An attorney can communicate with the IRS in your place, exist throughout audits, aid bargain negotiations, and maintain you from paying too much as an outcome of the audit

Part of a tax obligation attorney's obligation is to keep up with it, so you are shielded. Ask about for a knowledgeable tax lawyer and inspect the net for client/customer evaluations.

The Best Strategy To Use For Matthew J. Previte Cpa Pc

The tax attorney you have in mind has all of the ideal qualifications and testimonials. Should you employ this tax obligation lawyer?

The choice to work with an internal revenue service lawyer is one that need to not be taken lightly. Lawyers can be extremely cost-prohibitive and complicate issues needlessly when they can be resolved reasonably conveniently. As a whole, I am a large supporter of self-help lawful options, particularly provided the variety of informational product that can be located online (consisting of much of what I have actually published on the topic of taxes).

Not known Facts About Matthew J. Previte Cpa Pc

Right here is a quick list of the issues that I think that an internal revenue service attorney must be hired for. Allow us be entirely truthful for a 2nd. Crook charges and criminal investigations can ruin lives and carry extremely serious repercussions. Anyone that has invested time behind bars can load you know the realities of jail life, but criminal fees frequently have a far more revengeful effect that many individuals stop working to take into consideration.

Criminal fees can also carry extra civil fines (well past what is common for civil tax obligation issues). These are simply some instances of the damage that even just a criminal fee can bring (whether an effective conviction is ultimately acquired). My point is that when anything possibly criminal arises, also if you are just a potential witness to the matter, you need an experienced internal revenue service lawyer to represent your passions versus the prosecuting firm.

This is one Learn More circumstances where you constantly require an Internal revenue service lawyer enjoying your back. There are many parts of an IRS lawyer's job that are relatively routine.

The Ultimate Guide To Matthew J. Previte Cpa Pc

Where we make our stripes however is on technological tax obligation matters, which placed our complete capability to the examination. What is a technical tax concern? That is a hard concern to respond to, but the best way I would describe it are issues that call for the professional judgment of an internal revenue service attorney to fix correctly.

Anything that has this "fact dependence" as I would certainly call it, you are going to wish to generate an attorney to seek advice from with - Unpaid Taxes in Framingham, Massachusetts. Also if you do not maintain the solutions of that lawyer, a skilled factor of view when handling technological tax obligation matters can go a long method towards understanding concerns and solving them in an appropriate way